How the Property Tax System Works

The Assessor establishes the assessed value of your property by appraising your property as required by State Law. The assessed value of your property is placed on a list called the Assessment Roll.

The Assessor posts the property's assessed value on the Assessor's homepage in July which states the valuation of the property as of January 1. During this time the Assessor sends the Assessment Roll to the Auditor.

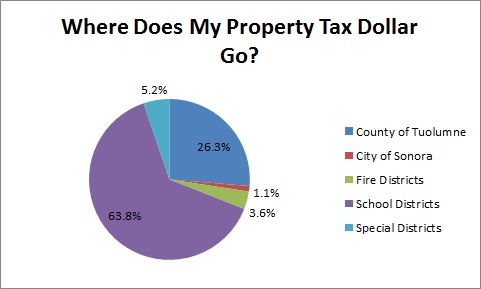

The Auditor Controller calculates the ad valorem tax rates and applies them, along with special assessments from taxing authorities such as the county, cities, school districts, fire districts, and special districts to the assessed value from the Assessment Roll, creating the Extended Tax Roll.

The Tax Collector uses the Extended Tax Roll to print the Tax Bill which is sent to the Property Owner. When the Tax Bill is paid, the Tax Collector records that payment against the tax balance due and releases the money to the Auditor Controller

The Auditor Controller then distributes the tax dollars to the appropriate taxing authorities, such as the county, cities, school districts, fire districts and special districts.